Office

First Canadian Place

100 King Street West

Suite 5600

Toronto, Ontario

M5X 1C9

Canada

By Sarah Keyes and Dustyn Lanz

The latest report from the Intergovernmental Panel on Climate Change (IPCC) shows that, in order to maintain a safe and stable climate, global greenhouse gas (GHG) emissions must peak and begin a permanent decline by 2025. To deploy the vast amounts of capital required to achieve this transition, capital markets need consistent and comparable climate-related financial disclosures from companies.

Within North America, the U.S. Securities and Exchange Commission (SEC) and the Canadian Securities Administrators (CSA) have proposed regulations which, if passed into law, would require corporate issuers to publicly disclose a range of practices related to climate change. Both regulators have issued public consultations. While the CSA’s comment period closed in February 2022, the SEC has extended its deadline to June 17, 2022.

Since the Canadian and U.S. markets are so interconnected, with TMX, NYSE, and Nasdaq hosting more than 200 cross-listed companies, a key question arises: How do the Canadian and American proposals stack up when compared side by side, and what are the implications for market participants?

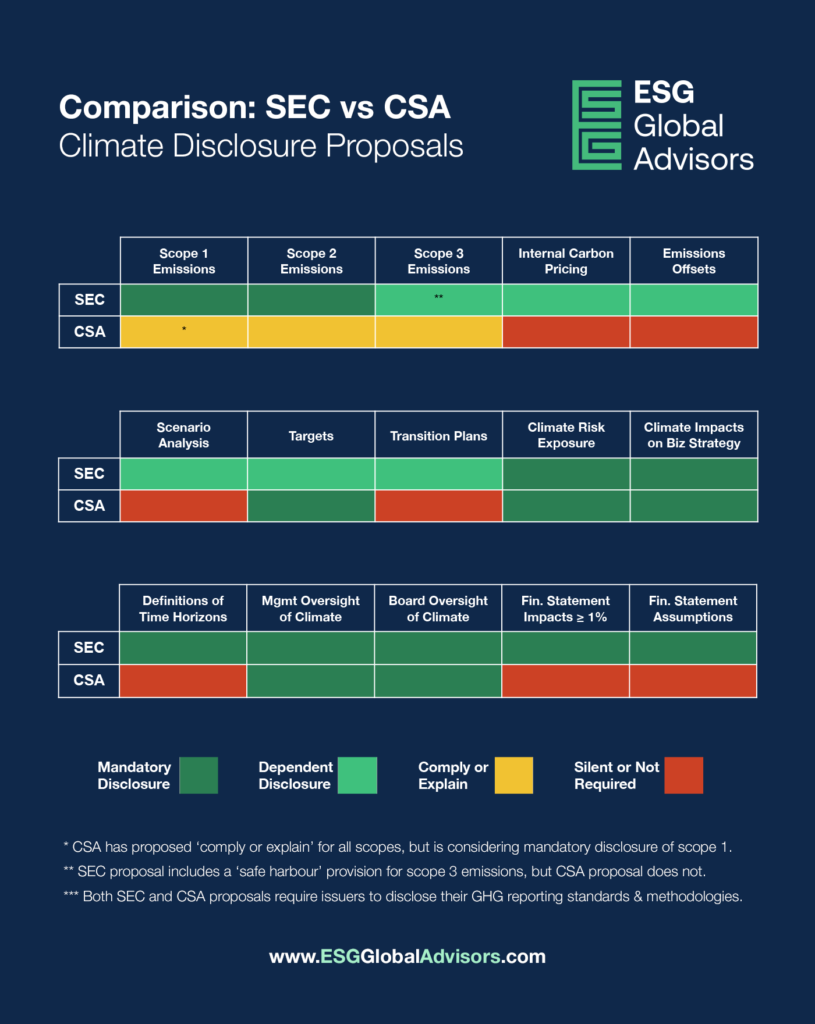

We’ve undertaken a comparative analysis of the proposals considering five aspects: (1) GHG Emissions; (2) Transition Management; (3) Risk Exposure & Impacts, (4) Governance & Oversight, and (5) Financial Statements. The figure below provides a snapshot of the two proposals based on these aspects, where deep green represents proposed mandatory disclosures, light green represents proposed dependent disclosures, yellow represents a proposed comply or explain model, and red signals that the respective proposal is either silent on the matter or does not require disclosure.

Since the SEC and CSA proposals commonly refer to materiality, and in some cases make disclosures mandatory dependent on it, we have provided both regulators’ definitions of this critically important concept below.

Canadian Securities Administrators (CSA) – Information is likely material if a reasonable investor’s decision whether to buy, sell, or hold securities of the issuer would likely be influenced or changed if the information were omitted or misstated.[i]

U.S. Securities Law – Information is material if there is a substantial likelihood a reasonable investor would consider the information important in making its investment or voting decision, or put another way, that the omitted or misstated item would have been viewed by a reasonable resource provider as having significantly altered the total mix of information.[ii]

It is important to acknowledge that these regulations are in fact proposals, and it’s possible that the final versions will change based on stakeholder feedback and, particularly in the U.S. context, potential legal or political challenges. Nonetheless, this analysis will provide useful insight to cross-listed corporate issuers about what they may expect in the coming months, and may also help those who are currently finalizing their responses to the SEC proposal.

| SEC | CSA | |

|---|---|---|

| Scope 1, 2, and 3 Emissions | Mandatory disclosure of scope 1 and scope 2 emissions, while disclosure of scope 3 emissions would be required only if the issuer has set targets pertaining to scope 3 emissions. Notably, there is a ‘safe harbour’ provision for scope 3 emissions to alleviate concerns about liability for information derived from third parties in a registrant’s value chain. | The CSA has put forward two options regarding the disclosure of emissions. The primary proposal suggests a ‘comply or explain’ approach where an issuer would be required to disclose its scope 1, 2, and 3 emissions or provide its rationale for not doing so. This is similar to the ‘comply or explain’ model the CSA uses for the disclosure of women on boards and in executive positions. Alternatively, the CSA is considering mandatory disclosure of scope 1 emissions, with scopes 2 and 3 following a ‘comply or explain’ model. No safe harbour provision is provided for scope 3 emissions in either of the CSA’s proposed options. |

| Internal Carbon Pricing | If a company has set an internal carbon price, it would be required to disclose the price in units of the registrant’s reporting currency per metric ton of CO2 equivalent,[iii] the total price and how it is estimated to change over time, the boundaries for measurement of overall CO2 equivalent on which the total price is based, and the rationale for selecting the carbon price applied. | There is no internal carbon pricing requirement. |

| Emissions Offsets | The following disclosures would be required if carbon offsets or renewable energy credits (RECs) are used to achieve climate objectives: (i) the amount of carbon reduction represented by the offsets or the amount of generated renewable energy represented by the RECs; (ii) the source of the offsets or RECs; (iii) a description and location of the underlying projects; (iv) any registries or other authentication of the offsets or RECs; and (v) the cost of the offsets or RECs. | There is no requirement regarding emissions offsets or renewable energy credits. |

| GHG Reporting Methods | While the SEC expects many registrants will follow the standards and guidance provided by the GHG Protocol when calculating emissions, the proposed rules would not require registrants to do so. However, all registrants would be required to describe their methodology, including their organizational and operational boundaries, calculation approach, and any calculation tools used to calculate the GHG emissions. | Mandatory disclosure of the reporting standard used by an issuer to calculate and disclose GHG emissions. If the reporting standard is not the GHG Protocol, issuers would be required to disclose how the chosen reporting standard is comparable with the GHG Protocol. |

| SEC | CSA | |

|---|---|---|

| Scenario Analysis | If an issuer uses climate scenario analysis, there must be a description of the type of scenarios, parameters and assumptions used, analytical choices, and projected financial impacts for each scenario. | Scenario analysis is not required. The CSA cited stakeholder concerns about the methods, costs, and usefulness of scenario analysis. |

| Climate Targets/Goals | If an issuer has set climate targets or goals, there must be a description of the scope of activities included in the target, relevant metrics, time horizon, baseline emissions, any interim targets, and how targets/goals are intended to be met. | An issuer would be required to describe the targets used to manage climate-related risks and opportunities and performance against targets where such information is material. |

| Transition Plans | If a company has adopted a transition plan, there must be a description of the plan, its metrics, and targets to manage exposure to physical and transition risks. | There is no requirement for a description of transition plans. |

| SEC | CSA | |

|---|---|---|

| Climate Risk Exposure | Mandatory disclosure of any transition or physical risks reasonably likely to have a material impact on business or financial statements over the short, medium, and long term. Companies would be required to describe the actual and potential impacts of climate-related risks to business operations and supply chains, as well as mitigation or adaptation actions and/or expenditures for research and development. | Mandatory disclosure of climate-related risks and opportunities the issuer has identified over the short, medium, and long term, where such information is material. This includes disclosure of the metrics used by the issuer to assess climate-related risks and opportunities in line with its strategy and risk management process where such information is material. |

| Climate Risk Impacts on Business Strategy | Mandatory disclosure of how climate risks are integrated into companies’ business strategy, financial planning, and capital allocation, and how any climate-related risks have affected or are reasonably likely to affect the company’s financial statements. | Mandatory disclosure of the impact of climate-related risks and opportunities on the issuer’s businesses, strategy, and financial planning where such information is material. |

| Time Horizons | Mandatory description of how the company defines short, medium, and long term time horizons, including how it takes into account or reassesses the expected useful life of assets and the time horizons for the company’s climate-related planning processes and goals. | No requirement to define time horizons. |

| SEC | CSA | |

|---|---|---|

| Management Oversight | Mandatory disclosure of management’s role in assessing and managing climate-related risks, including any specific positions or committees and their relevant expertise, and the frequency and processes for monitoring and reporting. | Mandatory disclosure of management’s role in assessing and managing climate-related risks and opportunities in addition to: (i) the issuer’s processes for identifying and assessing climate-related risks; (ii) the issuer’s processes for managing climate-related risks; (iii) how processes for identifying, assessing, and managing climate-related risks are integrated into the issuer’s overall risk management processes. |

| Board Oversight | Mandatory disclosure of governance of climate-related risks, including a description of the board’s oversight of climate-related activities, any relevant expertise, any board member or committee responsible for overseeing climate-related risks, the process by which the board considers climate-related risks, and whether and how the board sets climate-related targets or goals and oversees related activities. If applicable, an issuer can also elect to discuss the board’s oversight of climate-related opportunities. | Mandatory disclosure of the board’s oversight of climate-related risks and opportunities. |

| SEC | CSA | |

|---|---|---|

| Financial Impacts ≥ 1% | Mandatory evaluation and disclosure of the potential financial impacts of severe weather events, transition, and mitigation activities. Where evaluations show climate related-events or activities produce a 1% change to any line item in the financial statements, this would need to be disclosed in a note to financial statements. As part of the issuer’s financial statements, the financial statement metrics would be subject to an independent audit. | No requirement to disclose financial statement impacts ≥1% or other quantitative threshold. |

| Financial Statement Assumptions | Mandatory disclosure of the underlying estimates and assumptions used to determine any potential or known impacts on financial statements above the 1% threshold. | No requirement to disclose financial statement assumptions or estimates. |

Whereas the SEC proposal is focused on risks and expressly states that the disclosure of climate-related opportunities would be optional, the CSA positions the disclosure of both risks and opportunities as mandatory.

Whereas the SEC proposal would only require disclosure of information related to climate targets if an issuer has established targets, the CSA proposal requires an issuer to describe the targets it uses to manage climate-related risks and opportunities, as well as its performance against targets where such information is material. In short, the CSA proposal requires issuers to establish targets (if deemed material) while the SEC proposal does not.

The CSA proposal refers to the categories or ‘pillars’ developed by the Taskforce on Climate-related Financial Disclosures (TCFD). These include governance, strategy, risk management, and metrics and targets. Under the CSA proposal, the provisions within the ‘strategy’ and ‘metrics and targets’ pillars would be subject to a materiality assessment. If the issuer does not deem information in these two categories to be financially material based on its assessment of whether such information would influence a ‘reasonable investor’s’ decision to buy, sell, or hold securities of the issuer, then this information does not need to be disclosed.

While we recognize the ‘reasonable investor’ framing of materiality assessments is a well-established convention in both Canadian and American securities markets, we cannot help but wonder: Who is a reasonable investor in 2022? With the growing politicization around ESG and climate action in the U.S., are opponents of ESG and climate action considered to be reasonable investors under securities law? These questions are beyond the scope of this article, but they are important questions for regulators to consider as they develop their climate-related securities regulations.

Having said that, it is possible that regulators may need to be more detailed with respect to materiality determinations. The SEC has identified ±1% as financially material in its provisions regarding financial statements. Measures like this may prove to be useful for ensuring consistent and comparable disclosures in securities markets in an era of misinformation and political polarization surrounding climate change and other societal issues.

1. SEC Takes Priority for Cross-Listed Companies – The SEC’s proposed regulations are far more rigorous than the CSA’s. Therefore, unless dramatic changes are made, the SEC’s climate disclosure rules will likely become the go-to disclosure framework for cross-listed issuers. Compliance with the SEC’s proposed rules would cover nearly all the CSA’s proposed rules. A notable exception would be the CSA’s proposed mandatory disclosure of climate-related opportunities, which are optional under the SEC’s proposed framework. Another exception would be the CSA’s treatment of targets as mandatory (if deemed material). Cross-listed companies that comply with the SEC’s proposed rules while also disclosing their targets and exposure to climate-related opportunities would likely be operating in compliance in both Canadian and U.S. markets. On the other hand, cross-listed issuers who align their disclosures with the CSA would not be in compliance in the U.S. market.[iv]

2. GHG Emissions – The GHG Protocol is the globally recognized standard for calculating companies’ GHG emissions. U.S. and Canadian issuers would be well-advised to use the GHG Protocol to calculate and report on GHG emissions, particularly if they haven’t yet developed a baseline GHG emissions inventory. In addition, companies should focus on measuring and reporting their scope 1 and scope 2 emissions at a minimum, while recognizing that expectations for disclosure of scope 3 emissions are coming. Companies should put a plan in place to eventually measure and report on scope 3 emissions.

3. Transition Management – Companies that have set net zero targets should be prepared to disclose details on their climate targets and goals, with a focus on managing material climate-related risks (and for Canadian issuers, climate-related opportunities). According to CBSR, more than 120 Canadian companies have set net zero targets, which means these issuers will need to provide this disclosure, depending on the final terms of the CSA’s rule.

4. Risk Exposure and Impacts – Companies need to be able to demonstrate how climate-related risks are considered as part of their enterprise risk management systems and processes. Both the CSA and SEC proposals are focused on the qualitative processes in place to ensure climate-related risks are monitored and mitigated, consistent with the TCFD’s recommendations. Companies cannot assume climate change is de facto immaterial and these new rules further illustrate that issuers need to articulate how they have systematically considered climate change in their risk exposure and mitigation plans.

5. Governance & Oversight – Strong governance and oversight are often seen as indicators of a company’s ability to manage climate change impacts. Companies must be able to demonstrate the roles of management and the board of directors in overseeing impacts of climate change on business strategy, risk management and performance. Companies should be prepared to provide disclosure on the nature and extent of oversight activities, including the frequency with which climate change is discussed by the board.

6. Financial Statements – This is a key point of differentiation between the CSA and SEC proposed rules, with the SEC requiring more technical disclosures related to climate change impacts on the company’s financial statements. If included in the final rule, this component of the SEC’s proposed regulation will have significant implications for CFOs and audit committees. It will also result in more questions being asked by financial statement auditors on the impacts of climate change on individual financial statement line items.

As with all proposed regulations, it’s important for corporate issuers to monitor these developments and understand the potential implications for their reporting and disclosure obligations. While the regulations are still in flux and they will be phased in over time, we can reasonably assume that many companies will have a lot of work to do when they come into effect. Companies can be proactive by taking action now to formalize their strategies and processes for integrating climate change into corporate strategy, risk management, and governance. Those who do will be best positioned for compliance and operational excellence when the regulations take effect.

Learn more about ESG Global Advisors and our team.

[i] Form 51-102F1 Management’s Discussion and Analysis and Form 51-102F2 Annual Information Form; National Policy 51-201 Disclosure Standards, CSA Staff Notice 51-333 Environmental Reporting Guidance and CSA 51-358 Reporting of Climate Change-related Risks contain guidance on assessing materiality.

[ii] TSC Industries v. Northway, 426 U.S. 438, 439; Basic Inc. v. Levinson, 485 U.S. 224 (1988)

[iii] Greenhouse gas emissions are commonly calculated in terms of CO2 equivalents. Learn more via the GHG Protocol here.

[iv] Neither this statement, nor any other statement in this article, constitutes legal advice. Companies should consult their legal teams to ensure compliance.