Office

First Canadian Place

100 King Street West

Suite 5600

Toronto, Ontario

M5X 1C9

Canada

Updated: Jan 12

This blog is the first in a series of blogs by ESG Global Advisors that discusses the need for a transition taxonomy and the ongoing efforts being led by the Canadian Standards Association (CSA) Group to develop an approach that is additive to other global taxonomies and suits resource-based economies.

As the need to move capital into sustainable finance becomes more pressing, it also becomes increasingly important for companies and financial stakeholders to have clear definitions of “sustainable” projects and activities. There has been significant growth in “ESG” (Environmental, Social and Governance) investments and “sustainable” financial products. 2019 saw record-breaking flows into sustainable funds and the COVID-19 pandemic resulted in further record-breaking flows in the first half of 2020. Between April and June of 2020, ESG funds attracted net inflows of $71.1 billion.

However, there remains a lack of consistency, transparency and rigour in the defining criteria and measurement, ultimately affecting the credibility of these products. Many products are labeled as “ESG” or “sustainable” without a clear link as to how the product is contributing to environmental and/or social objectives. In the absence of clear industry standards, the private capital needed to accelerate the global transition to a sustainable, low carbon economy is not flowing at the pace and scale required to achieve the goals of the Paris Agreement.

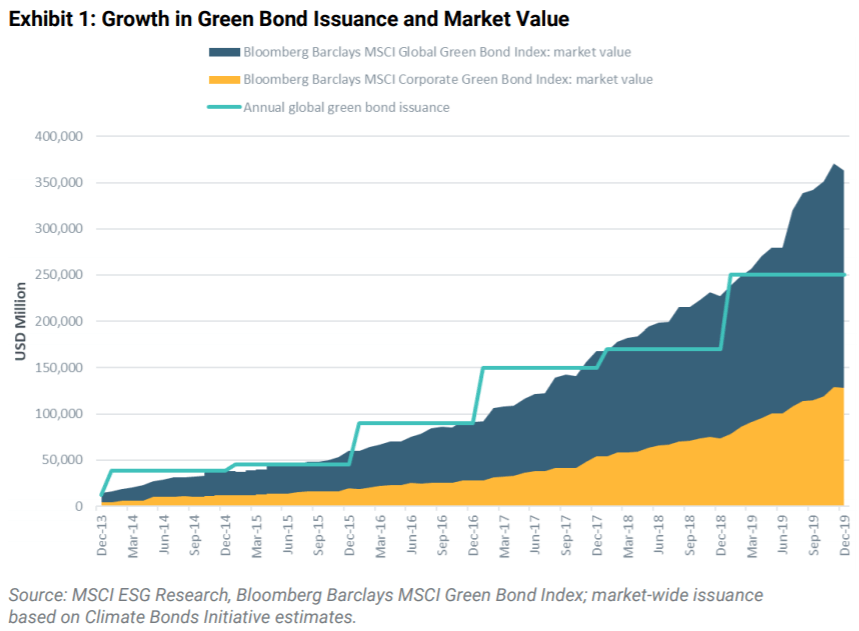

Growth of Green Bonds Green bond markets have emerged as an essential instrument to attract private capital to finance “green” activities. The green bond market has grown significantly in recent years. Annual global green bond issuance has tripled in market value between 2014 and 2019 (see Exhibit 1). Frameworks such as the Green Bond Principles have supported this acceleration by clearly defining which activities count as “green”.

There is growing interest in other areas of sustainable investments, such as “social bonds”, “sustainability bonds”, and “transition bonds” and the global landscape is evolving rapidly. The International Capital Market Association (ICMA) developed the Green Bond Principles, the Social Bond Principles and the Sustainability Bond Guidelines, which have become the leading global frameworks.

The COVID-19 pandemic has also led to in a significant increase in demand for social and sustainability bonds. From the beginning of 2020 to mid-May 2020, social bond issuance totaled $11.58 billion, compared to just $6.24 billion in the same period of 2019 and sustainability bond issuance totaled $25.62 billion, compared to $13.64 billion in the same period of 2019.

Despite widespread adoption of the Green Bond Principles, there are no universally accepted “transition” principles. As a result, there are many efforts underway globally to develop taxonomies to classify which activities qualify as “transition” as governments seek to implement action plans on sustainable finance (e.g. Climate Bonds Initiative, Green Bond Principles, International Finance Corporation, FTSE Green Revenues Classification System and EU Green Finance Taxonomy).

For example, the Climate Bonds Initiative is developing the Climate Bonds Taxonomy, which seeks to identify the assets and projects needed to deliver a low carbon economy that is consistent with the goals of the Paris Agreement.

Another high-profile transition taxonomy is the European Union’s taxonomy for sustainable finance. In July 2018, the European Commission convened the Technical expert group on sustainable finance (TEG) to support its Action Plan on Financing Sustainable Growth. Among other things, the TEG was charged with developing a unified classification system for determining whether an economic activity is “environmentally sustainable”, now known as the EU taxonomy.

The TEG published its final report on the EU taxonomy in March 2020. The report includes recommendations for the design of the EU taxonomy, implementation guidance on how companies and financial institutions can use and disclose against the taxonomy, and an annex with technical screening criteria for 70 climate change mitigation and 68 climate change adaptation activities. However, the EU taxonomy excludes certain “brown” industries, mainly solid fossil fuels, thus excluding “transition” activities that enable most “brown” industries to decarbonize over time.[1]

This is the case for many of the existing taxonomies: they exclude activities related to GHG emissions reductions in many segments of the natural resource or industrial sectors. This could have significant negative implications for resource-based economies, such as Canada, as companies operating in “brown” industries who are actively working toward decarbonization may be excluded from investment mandates, funds, and benchmarks based on current and/or proposed taxonomies. As a result, they would not be able to issue financial instruments to support their transition to lower carbon.

In Canada, the Expert Panel on Sustainable Finance (Expert Panel) was convened in 2018 and tasked with presenting “a set of recommendations to scale and align sustainable finance in Canada with our country’s climate and economic goals”. The Expert Panel’s final report was published in June 2019 and included a recommendation to expand Canada’s green fixed income market and set a global standard for transition-oriented finance. The report identifies the green fixed income market as “promising” albeit lacking depth and liquidity.

Acknowledging this issue, the Expert Panel recommended that key stakeholders be convened to develop a Canadian transition-oriented taxonomy that covers activities that support a transition to a lower carbon economy (even if those activities are being undertaken by a company operating in a “brown” industry). If the world is to achieve the Paris Agreement goals, it is critical that even the most GHG intensive industries are at the table and incentivized via access to capital to transition to lower carbon operations and processes. A purely green approach will not achieve the emissions reductions required to get to net zero by 2050. All sectors and industries must be engaged in the low carbon transition, including and perhaps most importantly for high-emitting industries.

What to Watch For: Canadian Transition Finance Principles and Taxonomy

The CSA has convened a Technical Committee consisting of Canada’s leading financial institutions and investors, as well as representation from a variety of natural resource-based sectors, and provincial and federal governments, in developing a standard to fill the current gap in transition taxonomy. The CSA’s Technical Committee strives to define transition in a way that recognizes natural resources sectors, focuses on GHG emissions reduction and the need for transition finance to support the achievement of net zero GHG emissions by 2050. ESG Global Advisors was engaged in an advisory capacity with The Delphi Group to support the CSA Technical Committee on Transition and Sustainable Finance (the Technical Committee) efforts.

At this stage, the following activities have been undertaken:

This is a voluntary, industry-led initiative. The various stakeholders supporting this initiative are committed to taking a leadership role nationally and internationally in helping to define the principles and activities related to the transition to a low carbon economy. This project is an example of that commitment.

Ultimately, the taxonomy will establish a definition of transition for the Canadian marketplace and identify projects and activities that shift carbon-intensive systems to become lower-carbon emitting for key Canadian sectors. This work is challenging as there are a number of stakeholders involved and discussions of this nature are still fairly new. Significant progress has been made and the Technical Committee continues its work through the fall of 2020.

This blog post is the first in a series of blogs that will explore the application of this taxonomy to key Canadian sectors. It will be important for both financial market participants and companies to follow developments related to the transition taxonomy, as it could have important implications for how capital is mobilized in the transition to a lower carbon economy in Canada and globally.

[1] “Brown” industries are generally considered to be those high-emitting industries, for example oil and gas or industrial sectors. Transition activities are activities that help high-emitting industries reduce their emissions. The EU taxonomy states: “Activities related to dedicated storage and/or transportation of any fossil fuels, including gaseous or liquid fossil fuels, should not be considered as making a substantial contribution to climate change mitigation”.

Questions about what this means for you and your organization? Contact us.