Office

First Canadian Place

100 King Street West

Suite 5600

Toronto, Ontario

M5X 1C9

Canada

By Heather Lang, Principal, ESG Global Advisors

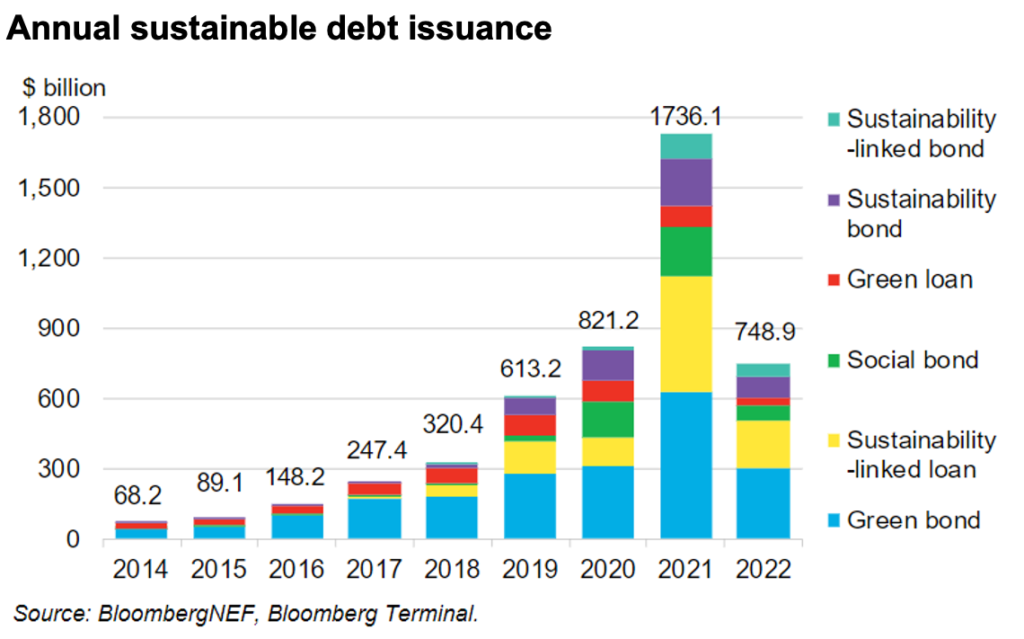

Capital markets have emerged as one of the fastest growing and innovative market segments for ESG, fueled by ambitious sustainable finance commitments from leading banks and corporate issuers. With a growing number of instruments in the sustainable finance toolkit, cumulative issuance of sustainable debt has surpassed $3 trillion USD.

Yet this momentum is being put to the test in the context of a volatile market and unprecedented scrutiny of greenwashing.

Against this backdrop, what are the benefits and drawbacks of these instruments, and how can market participants strengthen confidence in sustainable transactions?

Use of Proceed Instruments

Labeled green, social and sustainability (GSS) bonds and loans finance and/or refinance sustainable assets and activities based on their defined use of proceeds, selection process, management, and reporting in accordance with market guidelines (see text box). Since the first green bonds were issued by leading supranationals in 2008, the market has steadily soared, expanding into social and sustainability bonds/loans (the latter combining social and environmental proceeds). While green bonds continue to drive the market, they have decreased in relative market share with the emergence of new instruments.

Benefits: The impacts of use of proceed instruments are clear and direct.

Drawbacks: They are not indicative of an issuers’ broader ESG performance.

| Leading market principles and guidelines for issuance include: Use of proceed bonds: Green Bond Principles, Social Bond Principles and Sustainability Bond Guidelines by the International Capital Markets Association (ICMA). Use of proceed loans: The Loan Market Association (LMA & APLMA) and Loan Syndications and Trading Association (LSTA) have released complimentary principles for green and social loans. KPI-linked instruments: Sustainability-Linked Loan Principles by LMA and LSTA and Sustainability-Linked Bond Principles by ICMA. |

(Sustainability) KPI-linked Instruments

Sustainability-linked instruments (also known as KPI-linked) provide general purpose financing while incentivizing issuers’ sustainability performance by linking coupon/interest rates to predetermined KPIs and sustainability performance targets (SPTs).

With sustainability-linked loans (SLLs) ebbing and flowing since first introduced in 2017, the tipping point for KPI-linked instruments came two years later with the emergence of sustainability-linked bonds (SLBs). Since 2020, KPI-linked bonds/loans have experienced the highest year-on year growth within the sustainable debt market. Notable steps have been taken to raise the bar for KPI-linked transactions via enhancements to the Sustainability-Linked Bond and Loan Principles in response to growing scrutiny.

Benefits: KPI-linked instruments provide maximum flexibility to issuers.

Drawbacks: Their flexibility predisposes them to mounting scrutiny of greenwashing.

The Path Ahead

Sustainable debt finance has a vital role to play in supporting our transition to a low carbon economy while addressing other pressing sustainability challenges. Despite its extraordinary traction to date, we must recall that this is still a nascent market, at least a decade behind ESG in equity investment. With demand for sustainable bonds far outstripping supply, the first step was to broaden the tent of issuers and embrace innovation with a critical eye. But as the industry matures, its challenge is to safeguard the integrity of this highly scrutinized market through greater rigour and transparency.

Despite a temporary market slump, sustainable debt is expected to keep growing, propelled by ambitious commitments and massive pools of earmarked capital. Opportunities abound for companies to access these new pools of capital, while diversifying their investor base and showcasing their sustainability performance. Yet sustainable transactions require foresight and strategy, and companies that embed sustainable finance into their broader corporate ESG targets and objectives will be best positioned for success as the market expands and matures.

In our next issue of this series, ESG Global Advisors will outline foundational steps that position companies for sustainable transactions, aligned with rising market expectations.