Office

First Canadian Place

100 King Street West

Suite 5600

Toronto, Ontario

M5X 1C9

Canada

By Michelle de Cordova, Principal, ESG Global Advisors

Increasingly, responsible investment (RI) – the incorporation of environmental, social and governance considerations in investing – is becoming an expectation for many stakeholders, including donors, trustees, and others in the foundation, endowment and not-for-profit ecosystem. In a complex RI landscape that can sometimes seem overwhelming, how can asset owners – especially those with smaller teams – get started?

Over the past decade responsible investment (RI), defined by the Principles for Responsible Investment (PRI) as “considering environmental, social and governance (ESG) issues when making investment decisions and influencing companies or assets,” has entered the mainstream. Evidence that material ESG risks and opportunities can impact long-term portfolio value, and increasing demand from stakeholders, has created an expectation that investors should adopt RI, whether their assets are internally or externally managed.

For investors beginning their RI journey now – especially those with limited resources, including foundations, endowments, and not-for-profits – the challenge of navigating the RI landscape can sometimes seem overwhelming. Sources of complexity include:

A confusion of terminology

Under the broad definition of RI, a range of RI approaches exist, some which have multiple synonyms, or are inconsistently defined across the industry (see Table 1). A further source of confusion is the misconception that different RI approaches are mutually exclusive, when they can be – and often are – used in combination within a single investment strategy (e.g., a thematic strategy focusing on low-carbon opportunities, that applies ESG integration, and uses screening to exclude tobacco and controversial weapons).

Table 1: Defining RI Approaches

| CFA Global ESG Disclosure Standards Terminology | ESG Global Definition | Potential Sources of Confusion |

|---|---|---|

| ESG Integration | Structured consideration of ESG issues/factors alongside traditional financial factors to improve risk and opportunity analysis, seeking enhanced returns | – Other terms are used, including “sustainability risk” – Sometimes used incorrectly to describe the full scope of ESG-related approaches – Misconception that all RI approaches prioritize values over financial returns |

| Thematic & Sustainability Themed Investing | Investing in ESG thematic opportunities (e.g., low carbon solutions), typically seeking market-level returns | Misconception that all RI approaches prioritize values over financial returns |

| Impact Investing | Investing to create measurable positive sustainability impact, may accept below-market returns to achieve impact goals | – Other terms are used, including “community investing”, “sustainable investment” – Prioritization of “valuation” and “values” varies from fund to fund |

| Screening | Screening for alignment with values, typically via negative screens (e.g., tobacco) or positive (e.g., best-in-class), accepting any resulting consequences for returns | – Other terms are used, including “ethical investment”, “investment restrictions”, “exclusions” – Misconception that screening is the only RI approach |

| ESG Stewardship | Engage and influence investees to improve ESG performance via dialogue, proxy voting, collaborative initiatives, policy advocacy (not an investment approach, but can be overlaid with the other approaches) | – Other terms are used, including “engagement”, “active ownership”, “shareholder action” – Misconception that stewardship only applies to listed equity: while true for some tools (e.g., proxy voting), opportunities exist across asset classes |

A proliferation of standards

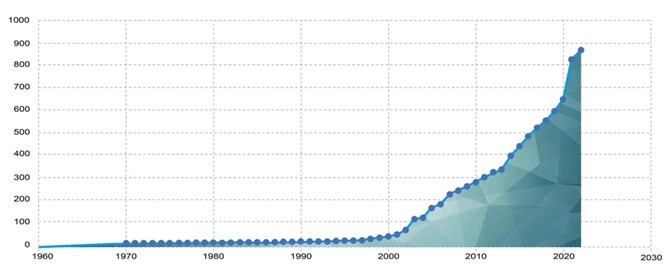

In the past, there were no criteria by which to judge an investor’s claim to be a responsible investor. More recently, a diversity of standards, initiatives, and regulations have emerged creating expectations for RI practice. As of 2022, PRI had identified no less than 868 policy interventions globally that support, encourage or require adoption of RI (see Figure 1), and the rate at which standards are appearing has accelerated significantly over the past decade (see Figure 2).

Figure 1: Cumulative RI Policy Interventions Globally (Source: Principles for Responsible Investment Regulation Database)

Figure 2: Timeline of Key RI Standards, Initiatives and Regulations

An intensification of scrutiny

Increasing investment flows into ESG funds have been accompanied by enhanced focus on the credibility of the RI practices of asset owners and the asset managers that work for them, from friends and foes of ESG alike.

Polarization: Investors may be criticized by stakeholders or civil society if their approach to RI is perceived (rightly or wrongly) as failing to address sustainability concerns: for example, asset managers may face criticism about how they vote on shareholder proposals relating to ESG concerns, while universities may face student campaigns for fossil fuel divestment. Conversely, as demonstrated by the recent anti-ESG campaign in the U.S., investors may be criticized if they are perceived (rightly or wrongly) as paying too much attention to sustainability impact.

Greenwashing: There are legitimate concerns about misrepresentation or overstatement of the extent to which investors incorporate ESG in their investment process. Regulation of ESG claims relating to investment products has become a global trend, including action by the European Union (EU), the U.S. Securities and Exchange Commission (SEC), and the Canadian Securities Administrators (CSA) (see Figure 2).

The complexity of the RI landscape today creates challenges, especially for investors that are just getting started. It can lead to differences of opinion on whether and how to adopt RI between key stakeholders, such as mission-focused experts and investment professionals on committees making investment decisions for foundations, endowments, and not-for-profits. Even with consensus on the need to adopt RI, it can be difficult to know where to begin, and how to identify and prioritize the baseline expectations for a credible RI program. In the face of these challenges, and based on our experience assisting investors to develop RI strategy, we recommend a step-by-step approach:

A step-by-step approach enables investors of all sizes to develop an effective and realistic RI strategy that incorporates RI approaches appropriate to the investment mandate, aligns with emerging RI expectations, and stands up to stakeholder scrutiny.

Need help getting started with RI? ESG Global offers customized services for investors (asset owners and asset managers), with portfolios of different sizes and across asset classes. Visit Our Services to learn more.