Office

First Canadian Place

100 King Street West

Suite 5600

Toronto, Ontario

M5X 1C9

Canada

ESG Global Advisors recently participated in Compensation Governance Partners (CGP)’s webinar presenting the results of the Governance Professionals of Canada (GPC) Corporate Governance Best Practices Survey. CGP covered key corporate governance trends of 2019 and then we spoke about ESG.

First, to offer context, we discussed what ESG is and why it is important. We find it helpful to frame the discussion by explaining the distinction between ESG and CSR as the two terms are often used interchangeably when in fact they are distinct. If you are interested in a more detailed explanation of the difference between ESG and CSR and some practical examples of material ESG issues, take a look at our piece A Material Difference: The Distinction Between CSR and ESG.

There are 3 key factors that explain what is driving interest in ESG:

1. The pull of performance

There is a clear link between ESG and performance. Companies that manage material ESG factors well tend to perform better on a number of measures over the long-term.

2. Push of regulatory and voluntary initiatives

There is an increasing universe of voluntary disclosures and initiatives that are pushing companies to disclose on their ESG risks and opportunities so that investors can better understand their exposure to ESG risks and opportunities.

3. Investor demand

Driven by the link between ESG and performance, large institutional investors are becoming increasingly active on ESG and are demanding that their asset managers integrate ESG and that their portfolio companies demonstrate oversight and proper management of material ESG factors.

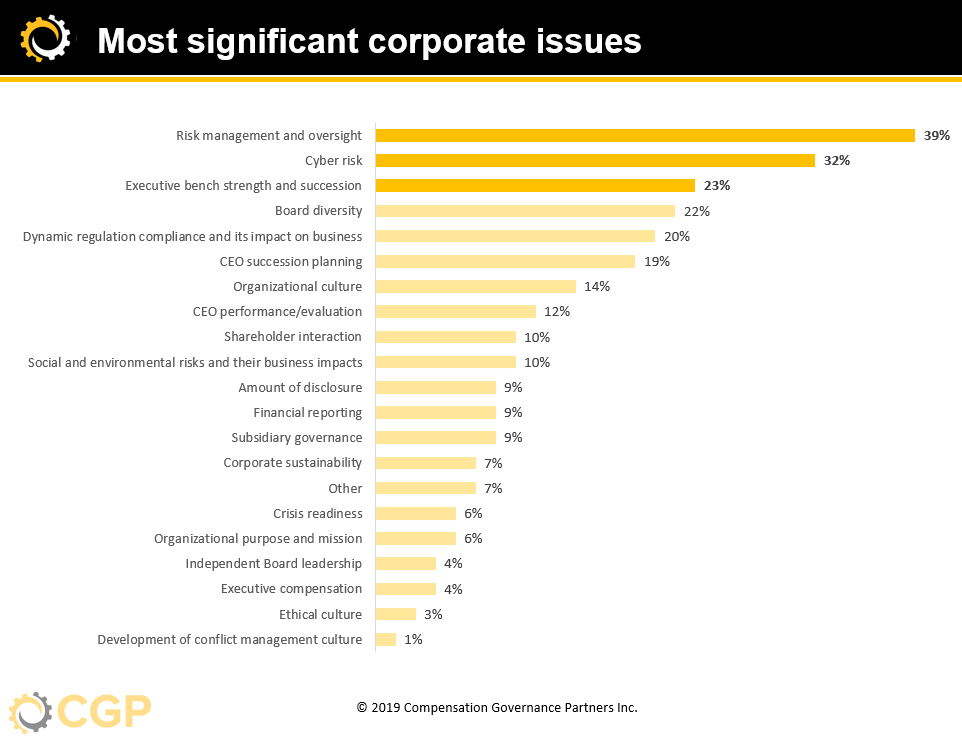

A lot of the recent evolution we have observed in the area of ESG was reflected in the results of the GPC survey. For example, survey respondents ranked the most significant corporate issues as follows:

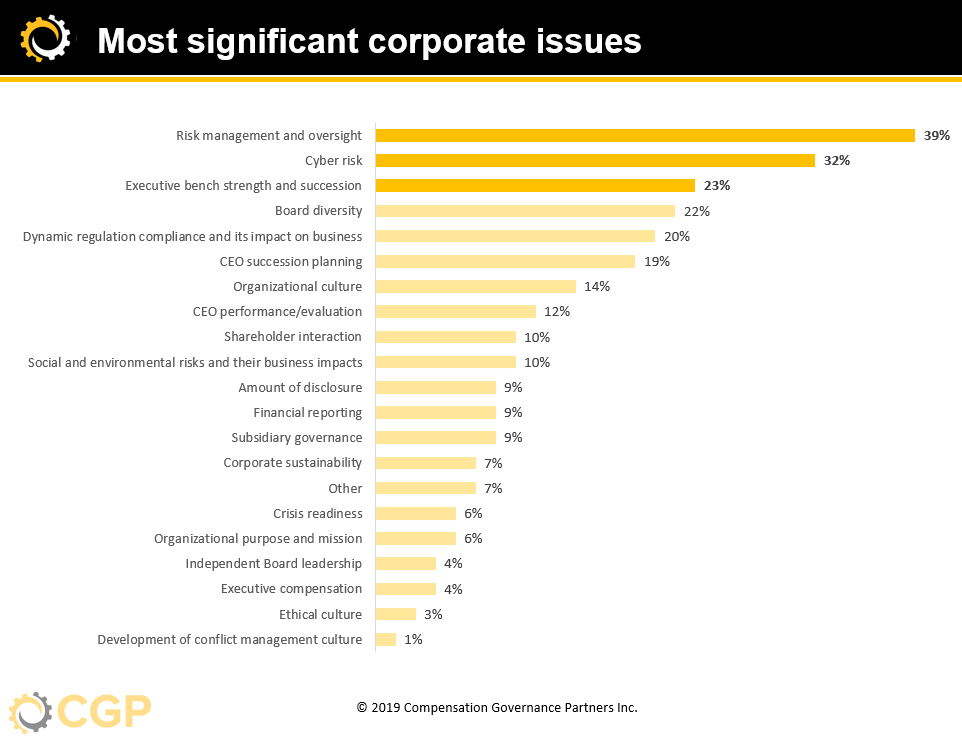

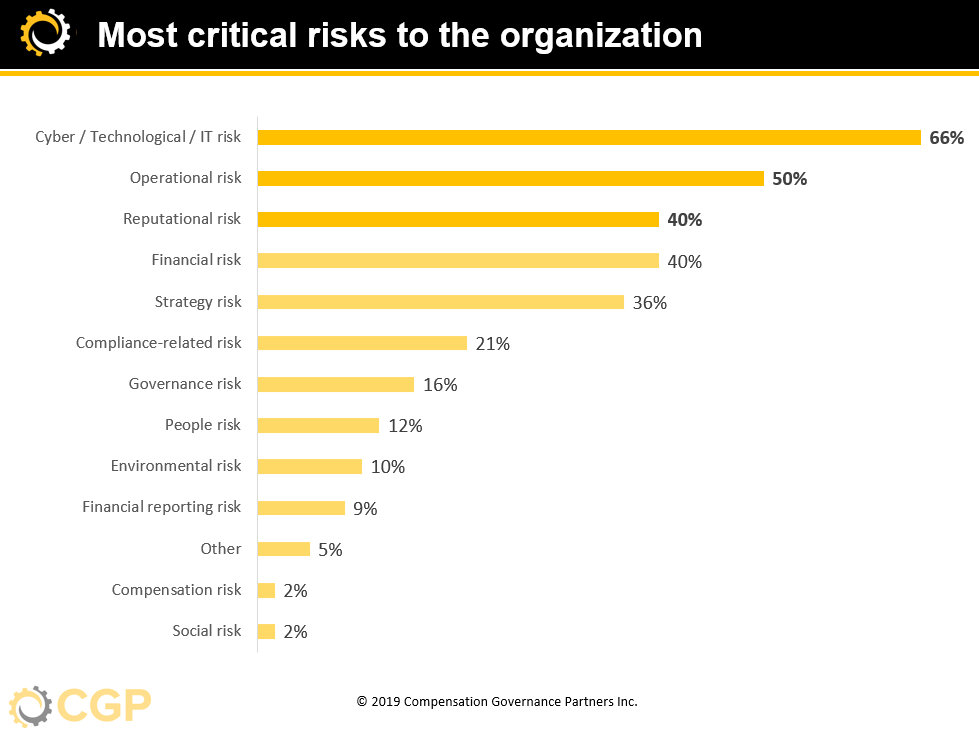

While “social and environmental risks” are ranked number 10, specific ESG issues are top of mind: cyber risk, board diversity and organizational culture ranked highly. Likewise, survey respondents ranked the most critical risks to the organization as follows:

While broad environmental and social risks don’t rank particularly high, specific ESG risks like cyber risk or reputational risk (which is very much tied to management of ESG factors) rank in the top 3. These results reflect what we observed when we were on the investor side and engaging with companies: companies might not label these risks as ESG risks, they consider them simply to be material business risks.

2/3 of survey respondents believe that there is agreement between the board and senior management on which ESG issues are material. This result is encouraging, as it is critically important that a company’s material ESG risks and opportunities are identified. As with any material business issues, material ESG issues should be subject to board level oversight.

The survey shared trends in engagement and we shared some observations on ESG engagements. Boards are increasingly involved in these engagements and investors are bringing up ESG issues more frequently. If the board is being proactive on ESG, by providing good disclosure on material ESG issues and initiating engagements with investors on ESG, the company will be in a good position to reduce its number of reactive engagements and control its ESG narrative.

Board diversity

Consider board diversity, ranked as a top concern for survey respondents. Over recent years, the expectations around diversity have evolved significantly. There is a clear link between diversity and performance, as well as significant reputational, legal and regulatory risk if the issue is not managed well. Armed with this information, institutional investors have been engaging and exercising their voting rights to push for greater board diversity. Consider this evolution:

Looking ahead, we expect to see the issue of board diversity evolve beyond simply gender diversity. As investors seek to promote all forms of diversity, they are calling for better data that will allow them to consider other types of diversity as part of their investment stewardship activities. We expect to see a focus on other types of diversity, beyond gender, in future years.

Compensation

The survey revealed that 69% of respondents don’t factor sustainability into their incentive plans. Increasingly, companies are being asked to demonstrate how ESG issues are considered as part of broader company strategy and some investors are starting to ask for the incorporation of ESG metrics in compensation plans (ex: joint statement between institutional investors on behalf of Climate Action 100+ and Royal Dutch Shell plc).

Executive compensation has always been, and will continue to be, a key focus for investors. The qualitative nature of many ESG issues makes this a challenge but we do expect to continue to see calls for the inclusion of ESG metrics in executive compensation plans. If you are interested in learning more about this evolving issue, CGP and ESG Global Advisors will be hosting a webinar on October 15, 2019 on sustainability metrics in Canadian executive compensation.

If you are interested, you can find the full Key Trends in Corporate Governance webinar recording here.